The ECN forex brokerage model has expanded significantly as demand for direct market access and transparent pricing increases among retail and institutional participants. Electronic Communication Network brokers connect traders to liquidity providers without a traditional dealing desk, altering execution mechanics and cost structures. The model matters because it reshapes how spreads, commissions, and order routing function in global currency markets, especially in high-volume trading environments.

What Defines an ECN Forex Broker

An ECN broker routes orders directly to a network of liquidity providers, including banks, hedge funds, and other market participants. Pricing is aggregated in real time, producing variable spreads that reflect underlying market conditions.

Key structural characteristics include:

No internal dealing desk intervention

Market-based spreads instead of fixed spreads

Commission charged per trade

Depth-of-market visibility in many platforms

Faster execution in liquid market conditions

The ECN structure is widely associated with institutional-style execution, although service quality depends on infrastructure, liquidity partnerships, and regulatory oversight.

Major ECN Brokers in the Global Market

IC Markets

IC Markets operates as a multi-asset brokerage known for low-latency infrastructure and aggregated liquidity pools. The firm offers ECN-style accounts designed around raw spreads with commission-based pricing. Its model focuses on high-frequency execution and institutional-grade order matching.

The broker supports MetaTrader and cTrader platforms, which are commonly used for algorithmic and high-volume trading. Regulatory licensing in multiple jurisdictions shapes operational oversight and client fund segregation standards.

Pepperstone

Pepperstone provides ECN-style execution through its Razor account structure, emphasizing tight spreads and institutional liquidity feeds. The company connects to tier-one banks and non-bank liquidity providers to deliver aggregated pricing.

Infrastructure investment in data centers near financial hubs reduces execution latency. The broker operates under multiple regulatory authorities, which affects compliance frameworks and operational transparency.

FP Markets

FP Markets offers ECN trading accounts structured around raw spreads and commission pricing. The broker emphasizes institutional liquidity access and direct market routing. Platform offerings include MetaTrader and IRESS, targeting both retail and professional participants.

The firm maintains cross-border regulatory coverage, shaping capital requirements and operational governance.

Tickmill

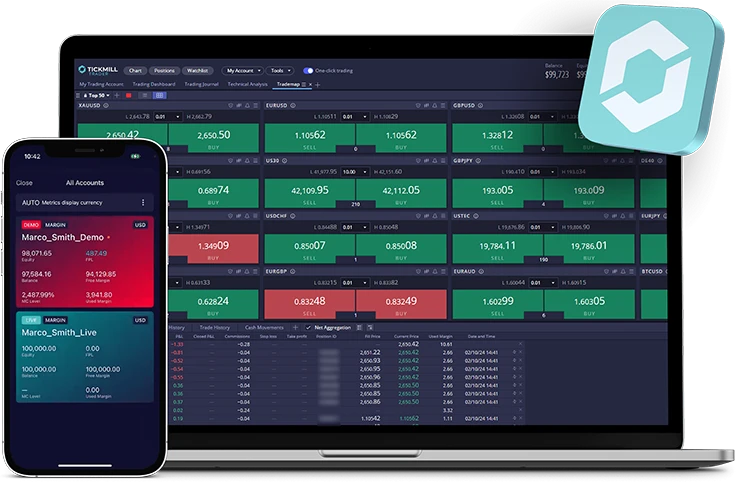

Tickmill operates an ECN-style execution model built around competitive commission structures and low spreads. The broker positions itself around execution speed and order transparency, with a focus on short-term and systematic trading environments.

Licensing in multiple jurisdictions influences compliance obligations and investor protection frameworks.

Comparison of ECN Account Structures

| Broker | Account Type | Spread Model | Commission Model | Platform Support |

|---|---|---|---|---|

| IC Markets | Raw Spread | Variable | Per lot commission | MT4, MT5, cTrader |

| Pepperstone | Razor | Variable | Per lot commission | MT4, MT5, cTrader |

| FP Markets | Raw ECN | Variable | Per lot commission | MT4, MT5, IRESS |

| Tickmill | Pro ECN | Variable | Per lot commission | MT4, MT5 |

Regulatory Landscape and Market Oversight

ECN brokers operate under financial regulators that impose capital adequacy, reporting requirements, and client fund segregation standards. Oversight varies by jurisdiction and influences operational safeguards.

Common regulatory considerations include:

Client fund segregation

Compensation frameworks

Leverage restrictions

Transparency obligations

Dispute resolution mechanisms

The regulatory environment affects broker stability, operational structure, and investor protection systems.

Execution Infrastructure and Liquidity Access

ECN performance depends heavily on:

Data center proximity to liquidity hubs

Aggregated pricing engines

Server latency

Order routing architecture

Technology partnerships

Infrastructure quality influences slippage levels, execution speed, and spread consistency during volatile conditions.

Frequently Asked Questions

What is the difference between ECN and market maker brokers

ECN brokers match orders within a liquidity network without internal dealing desk intervention. Market makers may internalize order flow and quote proprietary pricing.

Do ECN brokers always offer lower spreads

ECN spreads fluctuate with market liquidity. They can be narrower during high-volume sessions and wider during volatile or low-liquidity periods.

Why do ECN brokers charge commissions

Commission replaces the markup typically embedded in fixed spreads. The structure separates execution cost from market pricing.

Are ECN brokers suitable for algorithmic trading

Many ECN brokers support algorithmic trading due to low latency infrastructure and direct market routing, though platform compatibility varies.

Final Verdict

ECN forex brokers operate through direct liquidity aggregation, commission-based pricing, and non-dealing desk execution models. Infrastructure investment, regulatory oversight, and liquidity partnerships shape performance differences among providers. Market participants evaluate ECN brokers based on execution architecture, transparency, and operational safeguards rather than promotional positioning.

Post a Comment