Forex backtesting software remains a core tool in modern currency market analysis, allowing traders and institutions to test historical strategies using past price data. Its importance has grown alongside algorithmic trading, tighter regulation, and increased demand for measurable performance metrics. The market now includes several established platforms that provide structured testing environments, reporting tools, and historical data integration.

Why Backtesting Software Matters in Forex Markets

Backtesting platforms are designed to simulate trading strategies against historical data. This process helps quantify risk, evaluate consistency, and measure statistical edge without exposing capital. Institutional desks, prop trading firms, and independent analysts use these systems to validate models before deployment.

Key capabilities commonly include:

Tick-level historical data playback

Strategy automation testing

Risk and drawdown analytics

Trade journaling and exportable reports

Multi-currency simulation

Timeframe compression and expansion

These features support systematic evaluation rather than discretionary decision-making.

Leading Forex Backtesting Platforms

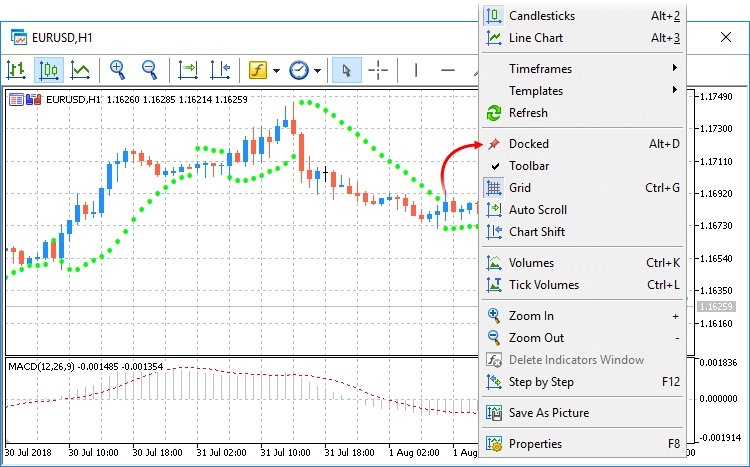

MetaTrader Environment

MetaTrader 5 is widely used in retail and professional forex trading due to its built-in strategy tester and support for automated Expert Advisors. The platform allows multi-threaded backtesting, visual simulation, and optimization testing across parameters.

Its ecosystem includes broker integration, third-party indicator libraries, and extensive community development. Historical data quality varies depending on broker feeds, but custom data imports are supported.

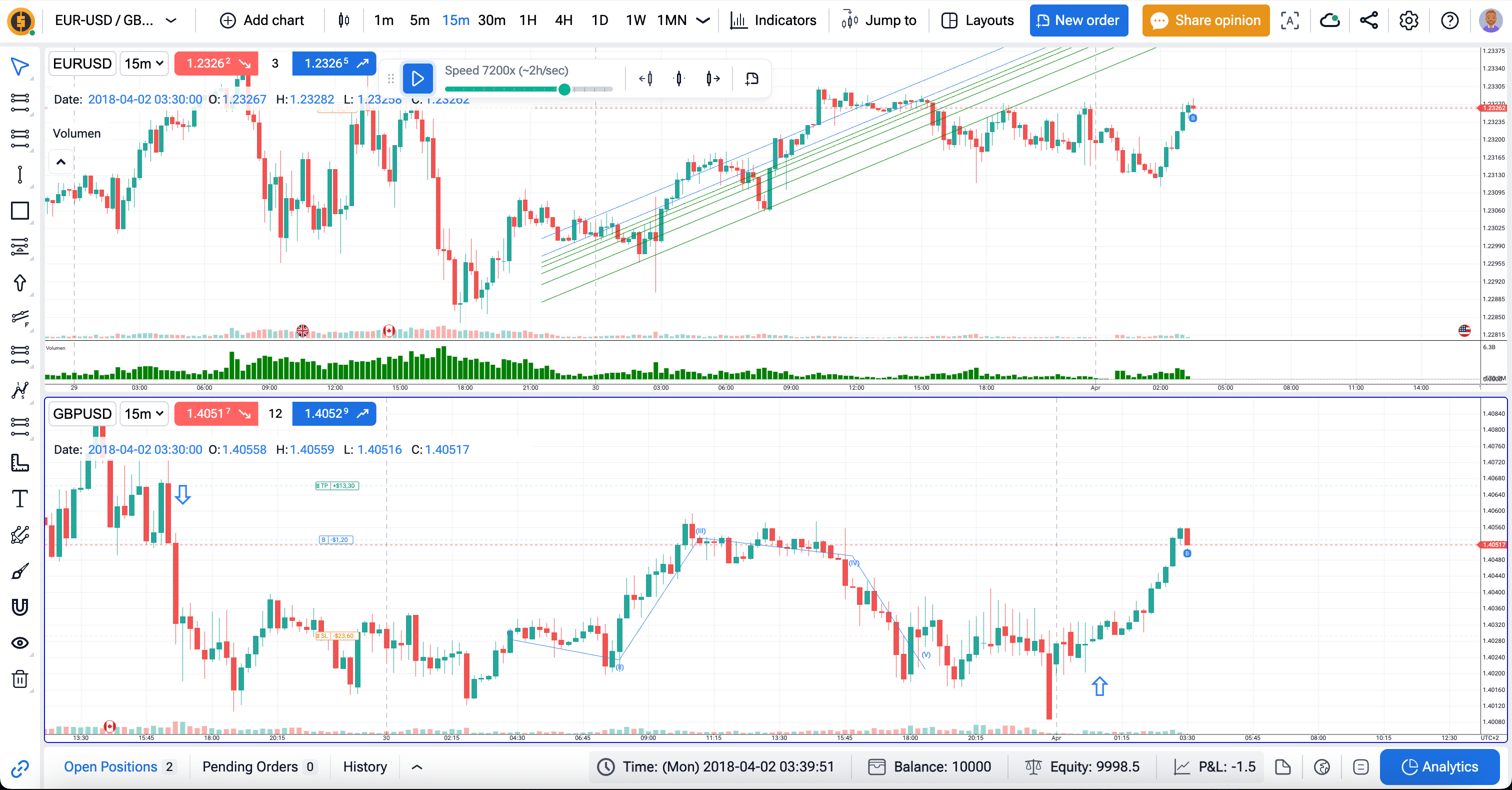

TradingView Simulation Tools

TradingView provides browser-based backtesting through Pine Script strategies and chart replay features. Its accessibility and cloud infrastructure make it widely used for visual strategy evaluation.

The platform emphasizes:

- Script-based model creation

- Multi-market testing

- Collaborative strategy sharing

Cloud data storage

While primarily chart-focused, its scripting engine allows structured quantitative testing.

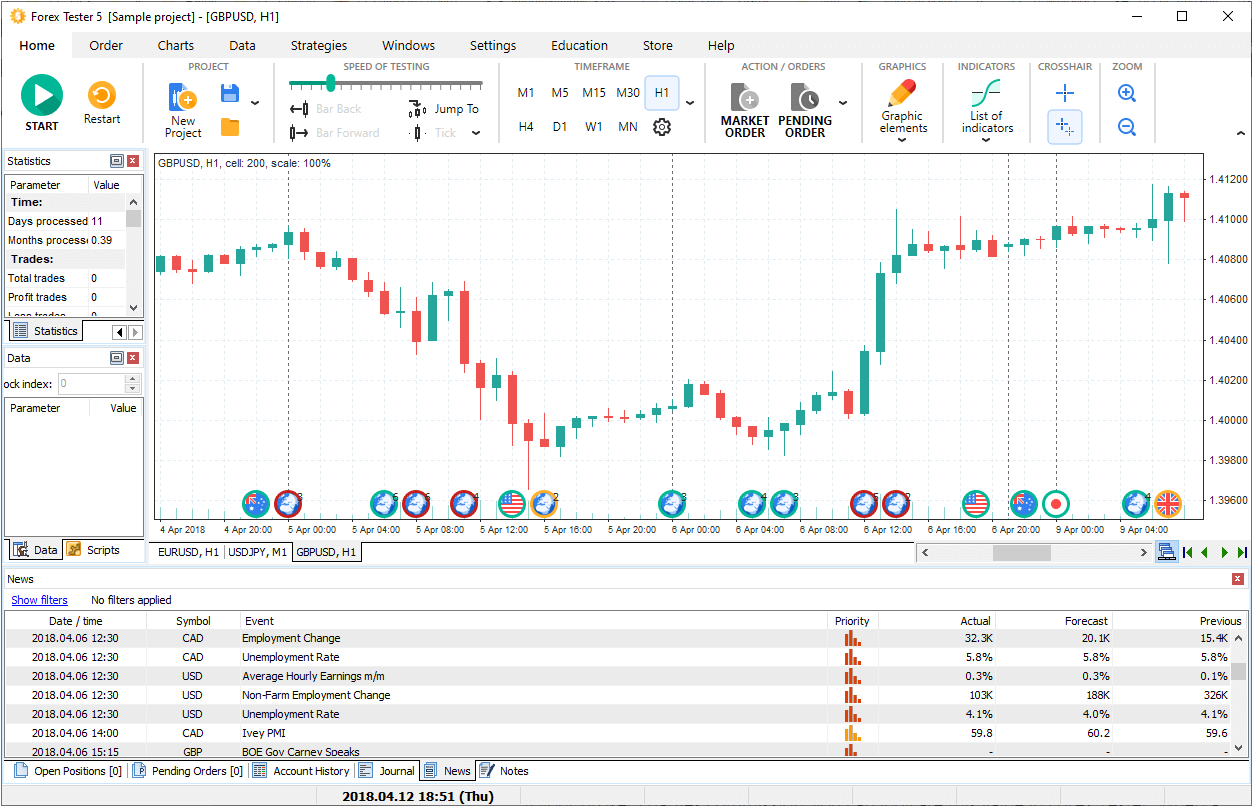

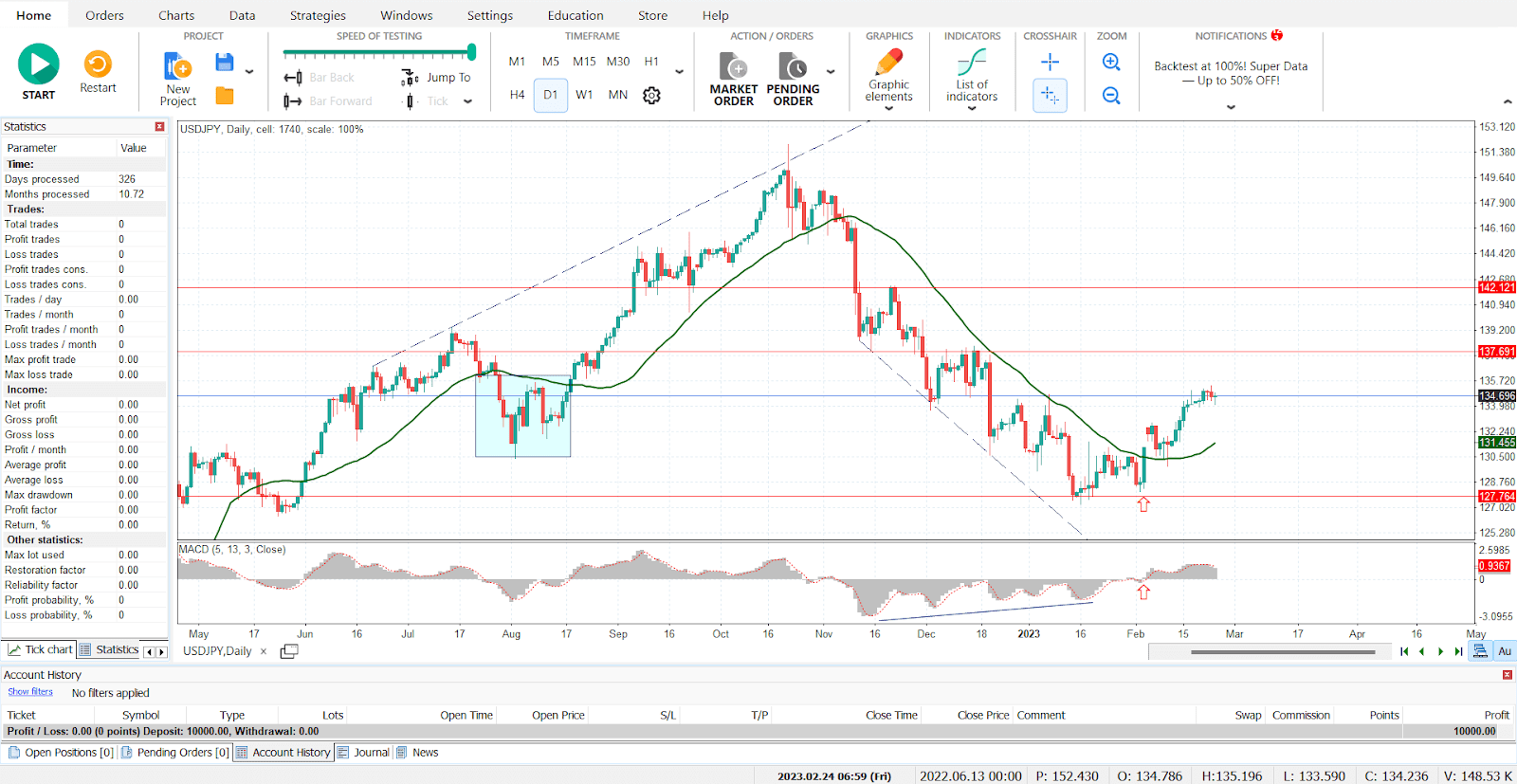

Forex Tester Dedicated Simulator

Forex Tester is a standalone simulation environment built exclusively for historical market replay. It emphasizes realistic execution modeling and trader behavior analysis rather than automation coding.

The software is often used in education and professional training environments because it replicates manual trading workflows, including order management and spread simulation.

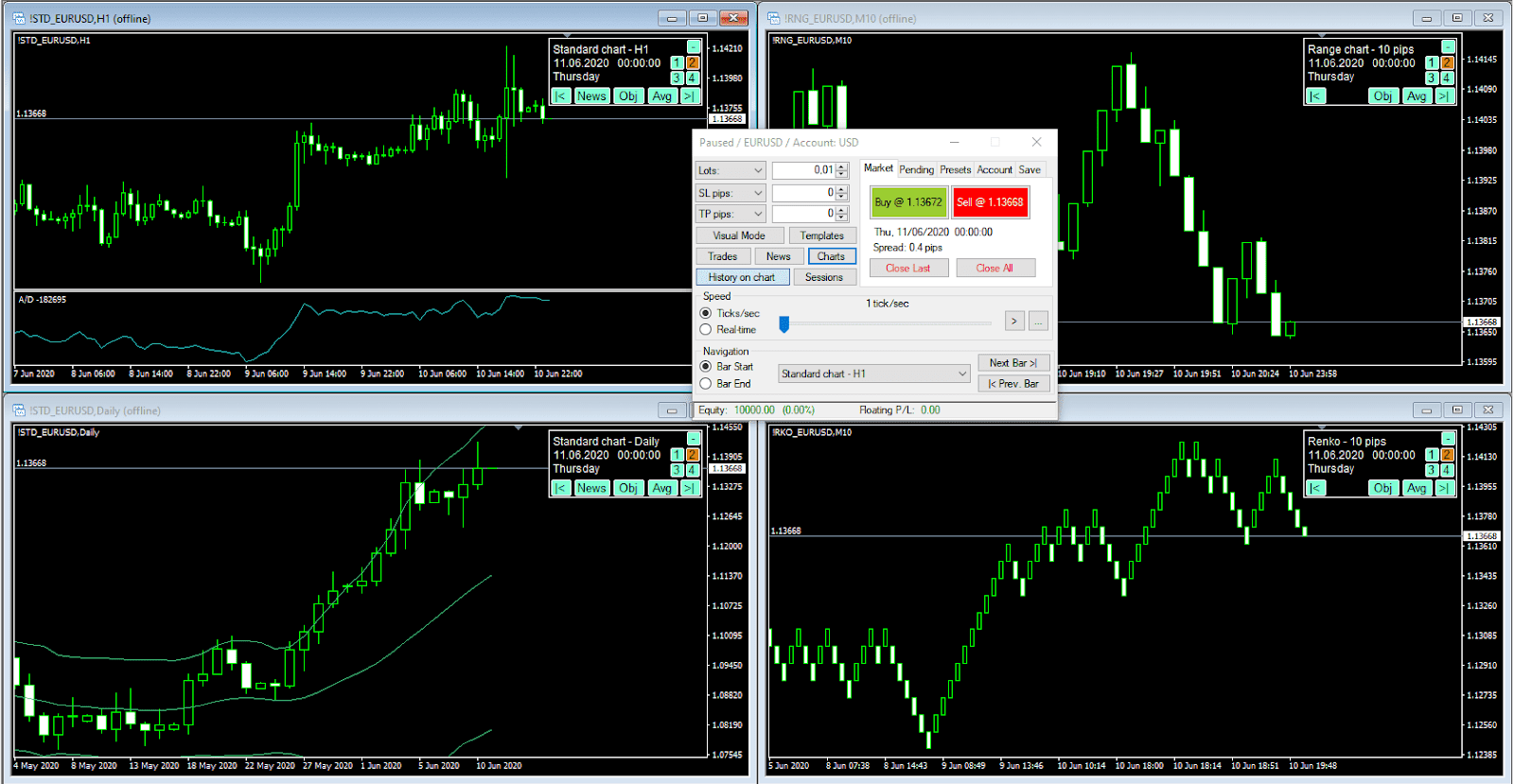

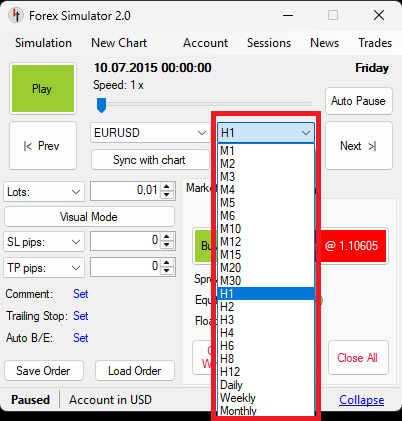

Soft4FX Historical Simulator

Soft4FX Forex Simulator integrates directly into the MetaTrader framework and enhances historical replay accuracy. It is designed to replicate live execution conditions within a familiar environment.

Its features include:

- Variable spread simulation

- Multi-timeframe synchronization

- Session speed control

- Trade analytics export

This structure allows extended practice without requiring separate platforms.

Platform Comparison

| Software | Deployment Type | Automation Support | Historical Replay | Data Customization | Primary Use Case |

|---|---|---|---|---|---|

| MetaTrader 5 | Desktop | Full | Moderate | Broker-based | Algorithm testing |

| TradingView | Web-based | Script-driven | Visual | Cloud data | Strategy visualization |

| Forex Tester | Standalone desktop | Limited | Advanced | Dedicated datasets | Manual training |

| Soft4FX | MT4 plugin | Partial | Advanced | Custom imports | Execution simulation |

Core Evaluation Factors

Selecting backtesting software typically depends on structural requirements rather than brand preference. Evaluation factors include:

- Data accuracy and tick resolution

- Execution modeling realism

- Strategy optimization capability

- Reporting transparency

- Compatibility with trading infrastructure

- Learning curve and workflow efficiency

Institutional research teams often combine multiple platforms to cross-verify results.

Frequently Asked Questions

What is forex backtesting software?

Forex backtesting software is a platform that simulates historical currency price movements to evaluate trading strategies without risking capital.

Does backtesting guarantee future performance?

Backtesting measures historical behavior only. It does not ensure replication under changing market conditions.

Is automated strategy testing required?

Automated testing is optional. Many simulators focus on manual decision-making and execution analysis.

Can historical data be imported?

Most professional platforms support custom data imports to improve accuracy and coverage.

Final Verdict

Forex backtesting software functions as a structured research environment for evaluating strategy performance using historical market data. Major platforms differ in deployment method, automation capability, and simulation depth, but all serve the same core objective: quantifiable testing before live execution.

Post a Comment