Risk management calculators designed for the foreign exchange market are seeing increased integration across retail trading platforms as market volatility continues to influence position sizing decisions. These tools automate exposure calculations, helping traders standardize capital allocation and quantify potential losses before entering positions. The development reflects a broader industry shift toward structured risk controls within online trading infrastructure.

What Is a Forex Risk Management Calculator

A forex risk management calculator is a digital tool that determines how much capital is exposed in a single trade based on account balance, risk percentage, stop-loss distance, and currency pair value. The calculator converts abstract risk tolerance into measurable lot size, allowing consistency across trading decisions.

Most calculators operate using standardized formulas that incorporate:

- Account equity

- Percentage risk per trade

- Pip value

- Stop-loss range

- Contract size

By automating these variables, the calculator removes manual estimation and reduces calculation error during fast market conditions.

Why Risk Automation Is Expanding

Currency markets operate continuously across global sessions, often experiencing rapid price swings triggered by economic releases, geopolitical events, and liquidity shifts. Retail participation has expanded significantly through mobile platforms and low-cost brokerage access. As a result, structured risk frameworks are increasingly embedded directly into trading software.

Industry analysts note that automated risk sizing tools help prevent overleveraging, a common cause of retail account drawdowns. Integration into trading terminals allows traders to evaluate exposure before order execution rather than after.

Core Components of Calculator Logic

Position Size Formula

At the foundation of most calculators is a position sizing equation:

Position Size = (Account Risk Amount) / (Stop Loss in Pips × Pip Value)

This ensures that the predefined risk percentage remains constant regardless of currency pair volatility.

Example Risk Structure

| Account Balance | Risk % | Stop Loss (pips) | Calculated Lot Size |

|---|---|---|---|

| 10,000 USD | 1% | 50 | 0.20 lots |

| 5,000 USD | 2% | 30 | 0.33 lots |

| 2,000 USD | 1% | 20 | 0.10 lots |

The table illustrates how changing stop-loss distance directly affects position size while preserving total risk.

Platform Integration and Accessibility

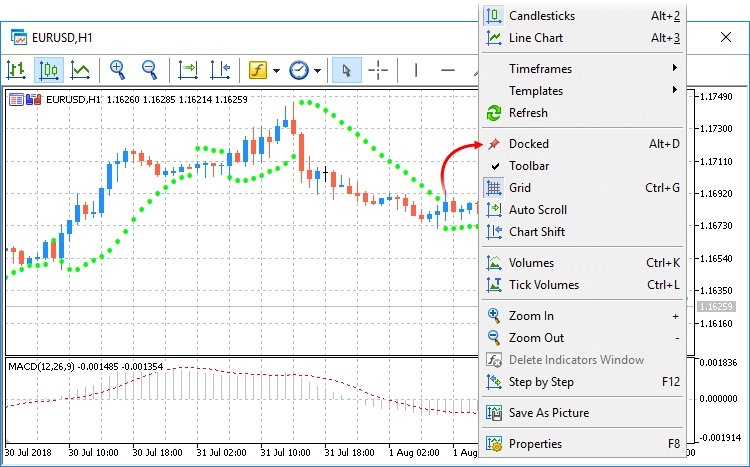

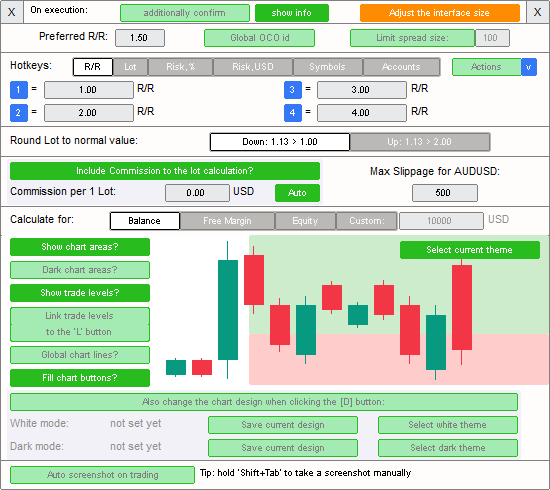

Risk calculators are commonly embedded in popular trading terminals such as MetaTrader 4 and MetaTrader 5, as well as browser-based brokerage dashboards. Many platforms provide built-in widgets that automatically sync account balance and leverage data, removing the need for manual entry.

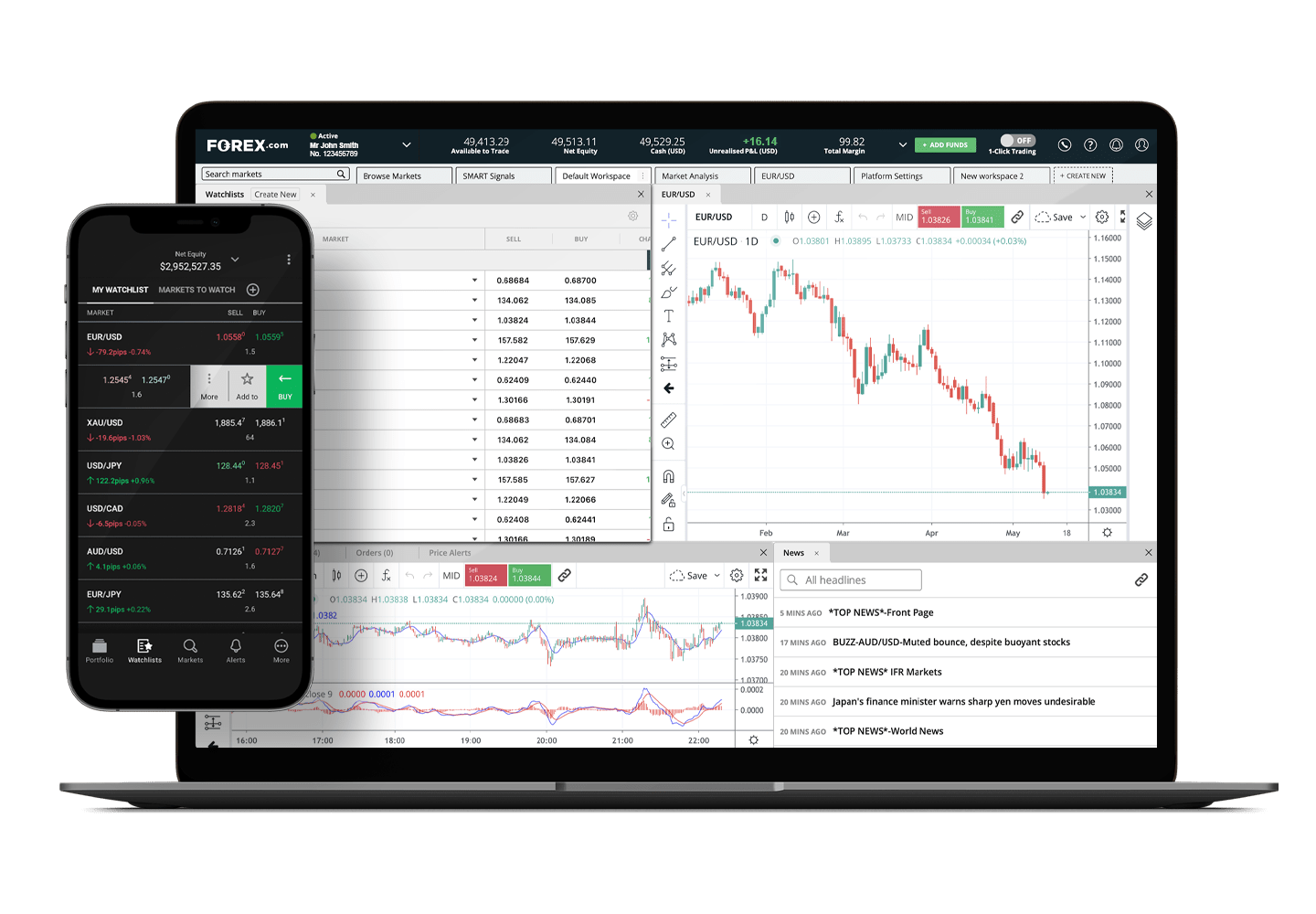

Mobile trading applications have also incorporated simplified versions of these tools, reflecting the growing share of transactions executed via smartphones.

Impact on Retail Trading Behavior

Data from brokerage reporting indicates that traders who apply fixed percentage risk models exhibit more stable equity curves compared to discretionary sizing. Structured calculators enforce discipline by translating emotional decisions into numeric limits.

Risk standardization is particularly relevant in leveraged markets where small price movements can magnify losses. Automated sizing introduces a mechanical safeguard independent of market sentiment.

Regulatory and Educational Context

Financial regulators globally have emphasized risk disclosure and leverage transparency in retail trading. Educational material from exchanges and broker compliance departments frequently includes calculator usage as a foundational risk-control method.

The rise of calculator adoption aligns with a broader industry effort to improve survivability rates among new participants entering currency markets.

Frequently Asked Questions

How does a risk calculator differ from a profit calculator

A risk calculator focuses on loss exposure before trade entry, while a profit calculator estimates potential gains after price movement. The two tools serve different analytical stages of trade planning.

Does a risk calculator guarantee loss prevention

The calculator does not prevent loss. It standardizes the maximum capital exposure per trade. Market slippage and execution conditions can still influence final results.

Are risk calculators broker-specific

Many calculators are universal and based on public currency pricing formulas. Some broker platforms include proprietary versions that integrate account data automatically.

Can risk calculators be used for other markets

The same mathematical framework applies to commodities, equities, and derivatives where position sizing and stop-loss parameters are defined.

Final Verdict

Forex risk management calculators represent a structural tool for quantifying trade exposure in leveraged currency markets. Their expanded integration into retail trading platforms reflects a shift toward automated discipline, standardized capital allocation, and formalized risk control within digital trading environments.

Post a Comment